A single form to complete, a clear and concise comparison, practical information on expatriation and the healthcare system in your expatriation country.

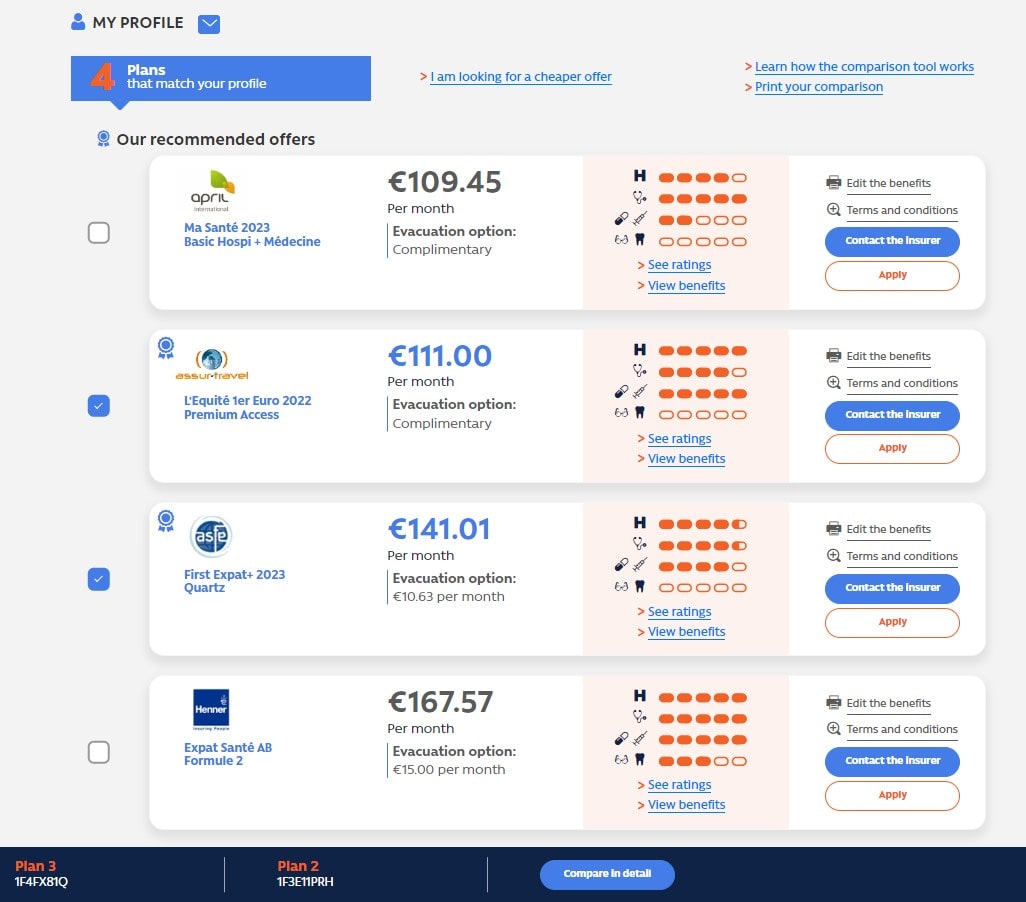

The rates displayed are the lowest available from each insurer. No additional fees are charged, our service is free of charge.

Experts help you choose independently. No insurance company is privileged over another. This is forbidden by our European laws.

They all offer quality services to their insurance holders around the world. All global health insurance companies can be included in the comparison chart. To be listed, they need to commit to our terms of use:

Inform insurance holders clearly about the plans they offer; contractual documents are available online, before you commit.

Transmit all the elements necessary for the comparison of their offers, so that our advisors can inform you in all transparency not only about their advantages but also about their limits and weaknesses.

Comply with the rules established by the French authorities (controlled by the ACPR) or by their country of establishment if they are equivalent to the French rules in terms of policyholder protection and financial security.

As an expat living in any country other than France, if you choose to be insured by a French global health insurance, you are protected by the French laws. And those laws are the most consumer friendly in the world.

The Caisse des Français de l'Etranger, is the French Social Security for expats. EU and

Swiss citizens can apply to the CFE. Its benefits are unparalleled.

It provides a good basis for reimbursement regardless of your preexisting medical

conditions, but must always be supplemented by a taylored health plan.

During your expatriation, you will benefit from a coverage as broad as that of the

French Social Security system, partly covering hospitalization, routine medical

expenses, dental care and maternity. It provides an essential base in the event of a

serious illness.

When you return to France, your social security rights are automatically restored

without the 3-month waiting period.

The main French laws on health insurance come from the Mutual Code; a set of laws

originally tailored for non-profit organizations and based on the principles of the

French Social Security.

Here are some examples of the benefits of these laws:

Once the contract is in force, the insurer cannot:

- terminate your policy if your health condition deteriorates;

- increase your rate individually according to the illnesses or accidents that have

occurred since your effective date;

- exclude a medical condition on the renewal date of the policy.

Critical illnesses, such as cancer or organ transplants, are reimbursed without any time

limit or specific ceiling.

Most contracts offer coverage without age limit.

And the cherry on the cake: the prices are generally lower than those of other global

health insurance.

How do I apply ?

Depending on the insurer, you can apply online or by exchanging a pdf. It is relatively simple except that in order to apply to a global health insurance policy, a health questionnaire must be filled out in every cases. You do not have to take any medical exams but if you have any pre-existing medical conditions you will have to declare them and the insurer may ask you to send your medical records.

Don't wait until you have a health problem to apply, it will be too late.

We have seen too many people in this situation not to insist on it. Sign up as soon as possible. Even CFE has restrictions to protect its policyholders and ensure its financial stability. If you ask for your affiliation several months after your departure, the CFE will logically impose a waiting period.

Read our guide

From hospitalization-only to comprehensive plans to fit your budget

Global health insurance represents a substantial but necessary expense because few countries

offer efficient social security systems, especially for newcomers.

A hospitalization-only plan is therefore essential, but if you can afford it, opt for a plan

that includes routine care, as consultations, and especially examinations and pharmaceutical

services, can be very expensive.

For hospitalizations lasting more than 24 hours, your expatriate health

insurance company will contact the hospital directly to avoid you having to pay up front

costs that can amount to several tens of thousands of euros. This system works worldwide

with all the insurers present on the site. It does not, however, concern routine medical

care nor pharmacy.

When you move abroad, you have to say goodbye to your health insurance card...

without regret, you'll see.

Additional options are available to be adequately covered in all circumstances. This is

important for you or your family's financial security.

Repatriation assistance: to bring you to a place where you can be

properly treated.

Civil liability: a guarantee that covers you for the damage caused by your

fault, recklessness or negligence.

Disability insurance: if you can no longer work, what income will you

have? This insurance will replace a portion of your income.

Our experts have compiled guides on more than 20 countries. The guides explain in detail how the local health system works and whether or not it is worthwhile to join an expatriate health insurance plan. Depending on the local rates and local constraints, you will know which plan is best.

We provide you with guides and checklists focused on global health insurance and various topics such as: maternity, insuring yourself with a pre-existing condition, choosing your status, points to check in your policy before signing, choosing your bank, etc.

After the online comparison, they help you to sort through the offers and find the one that really suits you. They all have several years of experience in expatriate health insurance.

« Let's get to know each other »

Covid-19 has changed the way we travel. Expatriation is also affected. This is due to political crises and changes in visa policies. This article gathers some rankings established on different criteria.

Expatriation is an exciting adventure that requires good preparation. When you have a disability, the questions to consider are even more important. What is expatriation like with a disability?

Some countries do not recognize the status of cohabitation or civil union pacts. For expatriates, this is a point to be checked when applying for a visa and in some cases, you will have to get married.